Chapter 2: The Public Sector

When Republican lawmakers regained control of the House of Representatives in 2023, their first legislative act was to cut funding for the IRS. The Internal Revenue Service, or IRS, is the federal agency responsible for collecting taxes and enforcing tax laws in the United States. This particular move was made to counter the increase that had passed the previous year while Congress and the White House were both controlled by Democrats, however it is by no means the first time there has been a call to cut, or even eliminate the IRS.

Support for agencies like the IRS is often divided along political party lines, and the IRS in particular has never been super popular with Republicans, who tend to favor smaller government and lower taxes. Republican disdain for the tax-collecting agency has been even more pronounced since it was involved with the enforcement of the Affordable Care Act in 2010 and then was criticized in 2013 for targeting conservative groups for falsely claiming tax-exempt status. In 2014 Republican congressional leaders led the charge for a $350 million cut to the IRS budget, the cherry on top of what added up to a $1 billion reduction since 2010. Ultimately, the number of employees at the IRS dropped substantially over this time period.

Calls to get rid of the IRS completely have become more and more common. In 2015 during the Republican presidential debate, candidate Senator Ted Cruz bashed the IRS as “fundamentally corrupt” and called for it to be abolished. This sentiment was echoed by the Republican party as a petition to “Stand with the GOP and fight to abolish the IRS” appeared on their website. The next year, a Republican Study Committee, which consisted of the majority of House Republicans, moved for the “complete elimination of the IRS.” Donald Trump, when he was a candidate didn’t call to abolish the agency, however he used his Presidency to support reducing their budget, keeping it at lower levels than prior to his presidency for all four years.

The idea that we could simply cut an agency whose main job is to take some of our money away from us each paycheck is undeniably appealing in some ways. Right around the middle of April every year the Internet blesses us with jokes (that aren’t really jokes) about how people feel about taxes and the IRS.

No one loves the United States tax system. Or paying taxes.

There are currently around 78,000 IRS employees. This is down considerably from peak levels in the 1990s where we saw as many as 116,000+ working for the agency in 1992. These employees are responsible for everything from sending out refund checks, to making sure your employer is paying in the proper amount, to, yes, auditing returns.

Each dollar we spend on the IRS leads to the government bringing in around $7. The nearly $80 billion over ten year increase that was part of the 2022 Inflation Reduction Act was estimated to bring in over $200 billion in revenue during the same time period.

How does that work? How does spending money increase money? It is largely because of employee capacity. For example, in 2008 IRS employee William Pfeil noticed something. Under U.S. law, any company that is doing business in the Gulf of Mexico owes the American government taxes. Pfeil, however, discovered that almost none of the foreign companies operating there were paying anything. Not only were there uncollected taxes at stake, this wasn’t a fair situation for the American companies that were paying taxes. The IRS began pursuing the companies that were supposed to have been paying in, ultimately bringing in over $50 million in unpaid taxes over five years. After those five years though, the program that focused on pursuing these businesses was shut down due to budget cuts.

According to the IRS, there are currently around 8,300 Revenue Agents employed with the agency. These are the people who perform audits of tax returns, with the goal of ensuring compliance with the U.S. Internal Revenue Code and bringing in money legally owed to the United States government. These agents bring in money…up to $9.00 per every $1.00 spent, in fact.

A force of over 8,000 auditors may seem like a large one, however it is pretty small, at least in relative terms. We haven’t seen so few working in this capacity since before Alaska and Hawaii were states, even though the population and economy are larger than ever before. There simply aren’t as many people employed, and there is more work to do. There are so few people working for the IRS that only 10% of telephone calls to the agency were answered in 2022. Audit rates have decreased to less than one-quarter of one percent. $3 billion is lost each year because the IRS doesn’t have enough staff to investigate “nonfilers.”

Who would do this work if there were no IRS is not something that is nearly as widely discussed as the idea of simply shutting the IRS down. The idea of a simpler system where taxes could be done via postcard and a minimal number of employees appeals to many, however that is not the tax system that the United States has. Instead, the U.S. has a very complicated system. Title 26 of the United States Code, which is the part of federal statute that deals with internal revenue has nearly 10,000 sections. The publication that includes the statutory code, all the regulations and revenue rulings, and relevant annotated case law called the CCH Standard Federal Tax Reporter is around 70,000 pages long. It takes people to unravel and enforce all of that.

As discussed in the previous chapter, the public and private sectors are two distinct areas of the economy that differ in terms of their objectives, governance, funding, and management. The public sector, funded with and managed by government resources, has the primary responsibility for providing a framework of laws and regulations that promote the general welfare and protect the rights of citizens. This chapter will discuss some of these key functions of government–not so much in terms of big philosophical ideals like the promotion of democracy, but more like the day-to-day functions that government provides that keeps the United States running (mostly) smoothly. These tasks, such as the provision of public goods and services, the maintenance of of law, order, and justice, national security, economic development and management, social welfare administration, and the protection of rights and freedoms are the things that make it so that even when there are political shake-ups and administrative transitions, your grandmother receives her social security check each month, trains show up on time, there is someone to call if you are in an accident, and money gets printed.

The Size and Scope of Government

The IRS is by no means the only agency for whom the guillotine is suggested. The departments of Education, Commerce, Energy, Housing and Urban Development and the Environmental Protection Agency face similar calls pretty regularly. But if these agencies all poofed out of existence, who would manage the United States nuclear arsenal? Who would be in charge of loaning college students money (and then making sure they pay it back)? The Department of Commerce houses the agency, the NOAA, that collects all of the weather data that we rely on for everything from choosing what outfit to wear to planning shipping routes for international trade. The Federal Housing Authority insures the loans for 20-25% of the houses that are purchased every year– largely for first-time homebuyers and people who don’t quite qualify for conventional mortgages. Would we just…stop doing that?

The notion that the government is too big and that we should take drastic measures to make it smaller is, perhaps, understandable. Popular opinion about government and public employees has declined steadily since the 1950s, with brief exceptions during the Clinton administration and right after the September 11, 2001 terrorist attacks. The federal government is too big, is not to be trusted, and needs to be cut back. Contrary to popular belief though, the size of the U.S. federal government, as a proportion of the U.S. population and economy, has significantly decreased over the past six decades.

As of January 2023 there were around 2.9 million civilian employees working directly for the federal government. This number has stayed relatively stable since 1950 at least partially due to the “Whitten Cap.” Jamie L. Whitten, a Democrat from Mississippi, introduced an amendment that year that prevented the federal government from filling vacant federal jobs with permanent employees during the Korean War. He placed the cap at 2 million employees, saying “…I thought 2 million permanent folks out to be enough to have on a permanent basis and I thought those ought to be protected in it. So what I did was fix approximately 2 million as all the permanents we are going to have.”

The Whitten Amendment was repealed, twice. First, Congress voted in 1965 to exempt US Postal Service employees from being counted as part of the 2 million. They repealed it completely in 1967. The cap lives on though, as it has become a standard campaign pledge and personnel management policy. So far we have not had any sustained time periods where federal direct employment remained over 3 million.

There are some major differences between the U.S. now and the U.S. in 1950. First, there are close to 200 million more people living here now (around 335,000,000) compared to then (around 150,000,000). In the first quarter of 1950 the Gross Domestic Product was just shy of $282 billion versus the fourth quarter of 2022 when it was over $26 trillion.

So, how are we running the government of a much larger country without increasing the number of government employees in proportion to the size of the growth? With more to manage but little political capital available to increase permanent government employment numbers, the government tends to use contracts and grant employees to get this work done. This method doesn’t appear to be going anywhere anytime soon as it appeals to politicians on both sides of the aisle. “The strategy has been attractive to many liberals because it has allowed them to expand government’s reach without making government bureaucracy bigger,” said public administration scholar Donald Kettl, and “It has been attractive to many conservatives because they have been able to swallow a larger government as long as the private sector delivered it.”

If you include everyone that is actually relying on the federal government for their paychecks there are over 9 million federal employees. That is right around 6% of the U.S. workforce. It is a lot, but it is not the biggest that it has ever been. As a percentage of the population, there was a larger federal workforce in almost every year prior.

We may not always be aware of it, but we “interact” with the government and its work many, many times a day. A recent Pew Foundation survey shows that 55% of Americans believe that the government isn’t doing enough to help people like them. Seven percent say the government does too much for them.. Let’s imagine a day in the life of a typical college student in the U.S. and try to identify some of the ways that the government is involved.

A Life, Lived

7:00 a.m. Your alarm goes off. You know that it really is 7:00 in the morning because the National Institute of Standards and Technology keeps the official time. Your alarm is a clock radio? Delightfully old school! You can listen to your favorite radio stations because the Federal Communications Commission regulates and organizes our telecommunications system. The FCC makes sure that multiple radio stations are not trying to use the same frequencies and that signals are not messed up by other devices, like cell phones, satellite signals, and modems, that all have signals crowding our nation’s airwaves.

7:35 a.m. Take a deep breath and prepare to greet the day. Notice that breath. You are very unlikely to choke on smog or other significant air pollution. It wasn’t always like that. In 1948, nearly two dozen people were killed and thousands injured by a cloud of air pollution from a factory in Pennsylvania. This accident marked the beginning of efforts to ensure that our air is clean and healthy. The Clean Air Act, signed into law in 1970 and strengthened in 1990, gave the federal government the authority to enforce regulations that limit air pollution.

7:36 a.m. If you are like 85% of Americans, you have a smartphone. And if you are like this author, you check it before you even get out of bed. The Food and Drug Administration (FDA) shares regulatory responsibilities for cell phones with the Federal Communications Commission (FCC). Under the law, the FDA is responsible for, among other things: Consulting with other federal agencies on techniques and programs for testing and evaluating electronic product radiation. The FCC does things like require that your provider make all of the charges in your bill clear and prevent scammers from stealing your phone number.

7:45 a.m. You stumble to the kitchen for breakfast. You pour some water into your coffeemaker. You probably don’t even consider the safety of the water, but in fact your city water department constantly monitors the quality of your water and takes measures to correct any problems.

7:46 a.m. Push the “brew” button on the coffee maker. It is unlikely that you worried about a short in the outlet or in the electrical line and the potential for fire. Why? Because when your house was being built, your local government required that the electrical system be inspected to make sure it was properly installed, and that it was installed by an electrician who was licensed by your state government to ensure their competence and your safety.

7:50 a.m. Breakfast today is a smoothie. Bananas, strawberries, dates, walnuts and almond milk, just like the fancy grocery store on Tik Tok but without the price tag. Food- borne illness affects thousands of Americans every year, but the likelihood of you getting sick from your breakfast is greatly reduced by standards on food quality set by the government and regulated by inspectors.

7:57 a.m. Maybe you were thinking of painting those ugly walls, but then you remember that you don’t actually own your house, your landlord does. You pay them rent in exchange for a lease, which gives you the right to live there. Your landlord is responsible for keeping your house safe, heated (and cooled in some places), and free of pests. Local governments provide this protection for renters and the courts are available to settle disputes in the case that someone tries to go back on the lease agreement.

7:58 a.m. Use the bathroom. Don’t forget to flush. Your local government then takes care of transporting this waste, treating it, and disposing of it in an environmentally responsible and sanitary manner.

8:00 a.m. As you are getting dressed, a glance outside the window shows some ominous clouds. You check the weather on your phone. All these weather forecasts, even ones you get from private news companies, are made possible by information gathered and analyzed by the National Weather Service (NWS), a government agency. Each day, the NWS uses its 122 weather forecast offices, 158 high resolution radar sites, 17 satellites, hundreds of weather balloons, 1,200 buoys, thousands of aircraft and ship-based observations, and tens of thousands of human observations to generate this data. And now you know what to wear today.

8:15 a.m. You drop a couple of bills in your mailbox to be mailed. For less than a dollar, a postal worker will pick up the bills directly from your house, take them to a place where they will be sorted and sent on until they are delivered in a few days to the appropriate company, even if that company is all the way across the country.

8:16 a.m. Hop in your car and pull out of your driveway. Driving can be very dangerous, but it is made safer by government laws and regulations, such as those that require that you “click it or ticket.” Seat belts save nearly 15,000 lives a year. Driving is also safer because of local government enforcement of traffic laws and safety standards on cars. Also, if you do get in an accident, it is far less likely that the effects will bankrupt you. The government requires that all drivers have auto insurance.

8:18 a.m. Your trip on the highway would be far less dangerous if not for the rules on the number of hours that truck drivers can drive without resting. Thousands of people die, and tens of thousands are injured every year from truck-related traffic accidents. These numbers would increase without the regulations that give sleepy truck drivers time to rest.

8:20 a.m. You arrive at school and take the elevator up to your floor. You just assume that the elevator is safe; and it is, thanks in part to the annual elevator inspections conducted by your state government. There is a little piece of paper inside of that elevator that tells you when it was inspected last.

8:30 a.m. Time to sit through a couple of classes. Maybe you go to a public university. Maybe you have student loans. Both of these things are provided by government entities. We have decided as a society that we all do better when we are a more educated group. And those student loans? Loans are never fun, but at least these are given at interest rates lower than regular bank loans.

Noon. For lunch you brought a sandwich and a cup of leftover soup. Why did you choose that soup when you were at the store? Perhaps you needed it to be dairy free. Gotta avoid the tummy ache. But how do you know which is the right soup for you? Because the government requires all food packaging to have a simple and honest label that contains the nutritional information necessary for consumers to make choices. Campbells and Progresso may tell you that their soups are delicious, but it is the government that makes them let you know if there is an ingredient in there that you don’t want. How concerned are you that the tomato in your sandwich is not coated in layers of pesticides? Probably not too much, because the Department of Agriculture has developed and enforces rigorous and uniform standards for pesticide residue on raw foods.

12:45 p.m. After lunch, you walk to a nearby ATM and get some cash out of your account. You don’t need to be surprised that your money is actually there. That wasn’t always true. For example, during the economic depression of the 1930s when many banks failed. But your money is safe because the government guarantees your deposits. That’s what the FDIC letters mean. And of course, those bills you withdraw are only worth something thanks to the federal government. The monetary system we use was created by and is run by the government. The value of that money is maintained because the government regulates the money supply and protects it from counterfeiters.

3:00 p.m. On a break, you call your elderly grandmother in the hospital to check on how she is recovering from her broken hip. What a good grandchild you are! Thanks to Medicare, her medical expenses are covered and she does not have to worry about this becoming a financial disaster for her. Considering her only income is her monthly Social Security check, this would be a real concern.

5:15 p.m. Whew. Time to drive home after a long day of class and studying. You stop at a local gas station to fill up. You pump 12 gallons of 87 octane gas into your car and pay for it. But how do you know that you really got 12 gallons, and not 11½? And that the gas was actually 87 octane? Because there is a sticker on the pump that indicates that it was inspected. Divisions of Weights and Measures inspect all kinds of things, like gas pumps and large animal scales, and grocery scanners. More than 50% of the U.S. Gross Domestic Product is based on things bought and sold by weight or volume, so making sure things are accurate is crucial.

5:30 p.m. As you drive home, you notice the trees next to the streets and the cute houses in your neighborhood. Thanks to zoning regulations our residential neighborhoods are generally free of, say, giant giant pork processing plants or noisy pet hotels or strip clubs. Zoning regulation keeps neighborhoods pleasant.

5:35 p.m. As you approach your house, you see an adorable child scootering down the sidewalk. The sidewalk that was paid for and laid down by the government. Not only do sidewalks give us somewhere to ride our scooters, they give us a place off the street to walk, which keeps us safe.

5:45 p.m. You go for a jog in your local public park.

6:30 p.m. A dinner date at a local pizza restaurant! You deserve it because of all of the working and jogging. The food is delicious and no one gets food poisoning. This is in large part because your local government conducts regular inspections of all restaurants to protect the health of customers.

8:00 p.m. Back at your house. You settle in for a quiet evening of studying. You are clearly an excellent and dedicated student…just a quick check of your socials first though. The internet is something that we often think of as a private enterprise, something provided through a combination of tech entrepreneurs in California and our local media companies. The internet began, however, with government programs that created ARPANET and later NSFNET, early computer networking systems that developed the software and networking infrastructure that form the foundations of today’s internet. The government also helped to fund research that led to web browsers like Internet Explorer and search engines like Google.

11:00 p.m. You go to bed. During your sleep, you are protected by a smoke detector that your city requires to be installed in every residence. Maybe you would have bought one of these yourself, but this law helps to ensure that everyone is protected from the dangers of fire.

4:00 a.m. You are asleep in your comfy bed. You remain comfortably unconscious because there are noise ordinances in many cities and towns that help keep your neighbors from partying all night long and keeping you up.

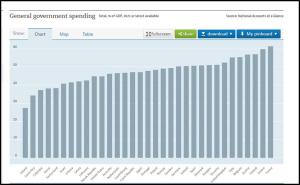

It should seem pretty clear at this point that the American administrative state is pervasive. It is not, however, the largest or most pervasive in the world. As a percentage of the economy, the United States falls into the bottom third of industrialized countries for government spending. Similarly, the U.S. tends to hover around 9th or 10th on the list of 32 OECD countries in terms of the percentage of the workforce employed in government service.

Types of Governments

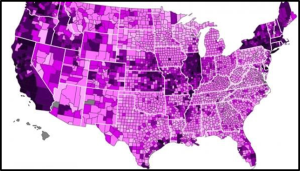

There is only one federal government in the United States, but there are also 50 state governments, as well as numerous local governments, including county and city governments. It can be difficult to accurately count the number of local governments in the U.S. because some cities and counties have multiple departments, agencies, and entities with varying degrees of independence and authority, which makes it challenging to determine the exact number of distinct governments. Additionally, new local governments can be created or dissolved over time, further complicating an accurate count.

Special purpose governments are public entities established for a specific purpose or function, such as providing a specific service or overseeing a particular aspect of local governance. Some examples of special purpose governments in the United States include:

- Special district governments which are set up to provide a service such as water and sewer management, parks and recreation, or fire protection, in a defined geographic area.

- Authorities, which are independent government entities that have the power to issue bonds and raise revenue, often for the purpose of financing large infrastructure projects, such as transportation or housing developments.

- Public corporations, which are governmental entities created to perform specific tasks such as operating public transportation systems, managing convention centers, or providing affordable housing.

These types of governments exist alongside traditional forms of government and typically have a specific charter, mission, and budget, separate from the broader government.

The Role of Government

We often think of the United States as having a capitalist economy, otherwise referred to as a market economy or a free-market economy. In a capitalist economy, the means of production are privately owned, and economic decisions are primarily made by individuals and businesses operating in the marketplace, rather than by the government. And while the U.S. economy is characterized by a significant degree of economic freedom, with limited government intervention in most sectors of the economy, the U.S. government controls or at least partly controls many goods and services. Consider postal delivery or roads, education and emergency response. All mostly government-controlled. And no matter how much money you have, you are not legally allowed to buy or sell cocaine, machine guns manufactured after 1986, or your kidney. Food can only be sold if it meets standards set by the Food and Drug Administration. You want to fire an annoying employee? Make sure you are following the rules set out by the Fair Labor Standards Act. Almost every type of industry and exchange in the U.S. is affected by rules and regulations, and in this way we can say that the country has the elements of a mixed economy. There are elements of both capitalism and socialism in the U.S., a mixture of free market capitalism and government intervention. And it is in this context that we find the role of the U.S. government.

Why do we have all of these employees and what is the point of all of this government anyway? The answer has to do with market failure. Market failures refer to situations in which the free market fails to efficiently allocate resources in a way that benefits society as a whole. In a perfectly functioning market, prices serve as a signal for both buyers and sellers, indicating the value of goods and services and allowing for efficient allocation of resources. However, in some cases, market forces do not work as intended and lead to inefficiencies, resulting in negative consequences for society. These inefficiencies can be caused by a variety of factors such as externalities, missing markets, market power, and imperfect information.

Externalities refer to the costs or benefits of a transaction that are not reflected in the market price, such as pollution or national defense. In other words, externalities occur when a transaction harms (negative externalities) or benefits (positive externalities) a third party. Sometimes these costs or benefits are small and do not have enough of an effect to create a need for government action, but when they are large they can become problematic and begin to impact other transactions and the functioning of society as a whole.

Pollution is a commonly used example of a negative externality. Imagine a factory making something, say, fertilizer. Farmers want this fertilizer to treat their crops and increase their yield, so they purchase the product. The fertilizer factory owner makes decisions in an attempt to maximize profits–sell as much fertilizer as possible, while incurring the lowest possible costs to do so. The problem is that fertilizer and fertilizer production is a significant source of water and air pollution. Nitrogen and phosphorus runoff is the leading cause of ecological “dead zones” in waterways, and the greenhouse gasses, like methane, released during the production of fertilizers is one of the major contributors of air contamination.

Is this just the cost of doing business in a capitalist society? Maybe, but at some point pollution begins to affect other parts of the market. Pollution stunts economic growth and exacerbates poverty and inequality in both urban and rural areas. It is the largest environmental cause of disease and premature death, causing more than 9 million premature deaths per year worldwide. That is 1 in every 6 premature deaths. The World Bank recently reported that air pollution cost the world around $8.1 trillion in 2019, which is the equivalent of over 6% of global GDP. This cost is not reflected in the transaction between the fertilizer factory and the farmer.

There are also positive externalities, and here the issue is the difference between private and public gains. For example, it is impossible to create a military defense system that only protects those who choose to pay for it. Military defense creates general security for everyone, even if some people would like to not to pay for it. Because of this, there is little reason for a private company to create a military to defend the country–because you can’t really exclude anyone from getting the benefits, there is no impetus for people to pay for the service.

People who benefit from a good or service without contributing to its production or cost are known as free riders. They enjoy the benefits of a particular resource, product or service without paying for it or bearing any of the associated costs or responsibilities.

In economic terms, a free rider is someone who takes advantage of a public good or service that is available to everyone, but does not contribute to its production or maintenance. This can create a problem for the provision of public goods, as the costs are spread across everyone, but the benefits are enjoyed only by those who choose to participate.

Examples of free riding can include people who use public roads and infrastructure without paying taxes to support their maintenance, or individuals who benefit from collective bargaining agreements negotiated by unions without joining the union or paying union dues.

In some cases, free riding can lead to a “tragedy of the commons” where the overuse or depletion of a shared resource leads to its degradation or collapse. The tragedy of the commons is an economic theory that describes a situation where a shared resource, such as a lake, a forest, or a grazing land, is overused or depleted because individuals or groups acting in their own self-interest consume or exploit the resource beyond its sustainable limit. This can lead to the eventual collapse of the resource, to the detriment of all those who depend on it. The theory is based on the idea that in a common-pool resource system, where no one person or group has exclusive control over the resource, individuals or groups will tend to act in their own self-interest, maximizing their own benefit by taking a smooch as they can from the resource without regard for its long-term sustainability.

The tragedy of the commons highlights the importance of managing shared resources in a way that ensures their sustainable use and preservation. This may involve the establishment or regulations, property rights, or other mechanisms that encourage cooperation and collaboration among users of the resource, as well as strategies to prevent or mitigate the negative effects of overuse or depletion.

Market power, or market control refers to the ability of a seller or group of sellers to influence the price or quantity of a good or service in a market. When a seller or group of sellers has market control, they have the power to set prices higher than they would in a competitive market, resulting in higher costs for the consumer and higher profits for the sellers.

There are various types of market control, including monopoly, oligopoly, and monopolistic competition. In a monopoly, there is only one seller in the market, giving them complete market control. In an oligopoly, a small number of sellers dominate the market, giving them some degree of market control. In monopolistic competition, there are many sellers in the market, but each seller offers a slightly different product, giving them some market control over their particular product.

Picture it like this: say that there are 3 different pizza restaurants in your area, Tony’s, Pizza John’s Pizza, and Punky’s. In order to get customers to eat at Punky’s, rather than at either of the other two options, Punky’s has to do something to compete. They either need to be the tastiest or the cheapest (or the best balance between these things). They probably will also need to do things like have a nice, clean facility and friendly employees, because if they don’t do all of this, customers will just hop on over to Pizza John’s Pizza or Tony’s. The competition between the restaurants encourages a quality product and a good price. But now say that Pizza John’s Pizza and Tony’s close and there is only one pizza restaurant left in town. People like pizza and will want to eat pizza, but Punky’s management might decide that they want more profits at some point. So, they reduce the amount of cheese that goes on each pizza by a little bit. Then, a while later they change brands of pizza sauce to a cheaper, but less tasty brand. And then they raise prices by 10%. Customers who want to eat pizza (which they do, because it is pizza), are left with an inferior product that costs more money.

This might not seem like a big deal when we are talking about pizza. After all, people don’t need to eat pizza. Sometimes, though, it can actually be something more like a life or death situation. For instance, in 2015 an entrepreneur named Martin Shkreli purchased the rights to an older medication called Daraprim. Daraprim is used to treat toxoplasmosis, which is a parasitic infection that largely impacts pregnant people, babies and people with HIV. It is the only drug approved by the FDA to fight this parasite. Prior to Shkreli’s purchase of the drug, it cost around $13.50 per tablet, however as soon as he acquired it Shkreli raised the price to $750 per tablet. His company then changed the way the medication was distributed and made moves to prevent competition from other drug companies. In 2022 the U.S. District Court for the Southern District of New York ruled that Shkreli had violated state and federal antitrust laws and had harmed consumers who were trying to obtain treatment for life-threatening diseases. Shkreli was fined $64.6 million and was barred for life from the pharmaceutical industry.

Imperfect information refers to a situation where not all relevant information is available or known to one or more parties involved in a decision-making process. Imperfect information is a market failure because it prevents buyers and sellers from making informed decisions about their transactions, which can lead to outcomes that are not optimal and that generally favor industry over consumers.

Consider Melvin, who would like to buy a used car. Let’s assume that Melvin knows very little about how cars work. He is a smart guy though and knows to do things like reading Consumer Reports and looking at websites with details about different kinds of cars and what they should cost. He is even planning to pay a mechanic to check out a car he is interested in buying. Even after doing all of this background work, Marvin still cannot be 100% sure that he is buying a high-quality used car. He knows that he might buy the car, drive it home, and use it for a while before finding out that the car is a “lemon.”

Imagine that Melvin finds two used cars that are similar in terms of mileage, body condition, and age. One car costs $6,000 and the other costs $7,000. If Melvin were car shopping in a world of perfect information, it would be pretty obvious what Melvin: buy the cheaper car. However, he is operating in a world of imperfect information, and the sellers most likely know more about the cars and their problems than Melvin does. What’s more, sellers have an incentive to hide the information. After all, the more problems the cars have, the cheaper they will need to be.

One might wonder, again, if this is just the risk one takes when doing business. After all, “caveat emptor”, or “let the buyer beware.” Potential buyers need to take responsibility for doing their research and making wise decisions, right? Well, yes and no. A capitalist economy such as the one in the U.S. requires the circulation of capital, and the presence of an information imbalance can discourage both buyers and sellers from participating in the market. Buyers may become reluctant to participate because they cannot determine the product’s quality or fear being ripped off. Sellers, especially those of high and medium quality goods, may be reluctant to participate because it is difficult to demonstrate the quality of their goods to buyers in order to sell them at a fair price.

When this happens markets may become extremely thin as a relatively small number of buyers and sellers agree to take part.

Asymmetric information also can happen in markets that are very complicated. Do you have a credit card? When you got it, and periodically afterward you would have received the terms and conditions paperwork. A study a few years ago looked at more than 2,000 credit card agreements and found that there are nearly 5,000 words in each, on average and that they are written in language that is above the reading levels of most

Americans. How can any one of us hope to have a fair relationship with our credit card companies when it is unlikely that we could understand the terms of our agreement without the assistance of a lawyer?

Another type of market failure occurs when there is a demand or need for something, but that thing is not provided by the market. This can be because of a temporary shortage, such as when baby formula became difficult to find in 2022 due to factory closures, or when areas hit by natural disasters have trouble getting fuel for cars. It could be because of uncertainty. Many people would like for cars to create less pollution, but a number of consumers are hesitant to purchase electric cars due to a lack of information about their long-term performance and the availability of charging stations. Suppliers, on the other hand, are hesitant to produce these cars because of the uncertainty felt by consumers. So, even though a lot of people think electric cars might be a good thing, there is a missing market in the car industry.

Another reason for missing markets is that there are things that we find desirable as a society but that simply aren’t profitable for private industry. This is often the case with what we call pure public goods. A pure public good is defined by two traits, both critical to its definition. For a good to be a pure public good, it must be both non-rivalrous in consumption and non-excludable in consumption. A private good, say a taco or set of false eyelashes, is rivalrous in the sense that if you eat the taco or wear the lashes, no one else can. A good is nonrivalrous then if your one person’s consumption of the good does not attack the ability of others to consume the good.

For example, the sidewalk in front of your house is a resource such that if you use it to safely walk your dog without being hit by a car, it does not diminish the ability of anyone else to receive the same benefit. Police protection, courts of justice, radio and television airwaves, and many other goods share this property.

The second trait defining pure public goods is equally critical to understanding their nature. A pure public good must be non-excludable in consumption. For ordinary private goods, the customer must pay for the good or they are unable to acquire it. If you don’t pay the $1.69, Taco Bell will not give you a taco. Consider again, the sidewalk. Once the sidewalk is built, if you are in a regular public neighborhood it is not possible to exclude anyone from benefiting from it being there.

The non-excludability of pure public goods is the trait that is critical to why such goods are not profitable to supply privately. Suppose, for example, that you were considering building a giant air filtration system that would clean up your air, but also many hundreds or thousands of peoples’ air downwind from you. So, you approach them asking for money to help pay for the expensive contraption that will benefit everyone. Each household you approach will realize something–if the contraption gets built, they cannot be excluded from receiving the benefits, whether they give you money or not. You might as well keep your money and free-ride away. It is similar to the problem with positive externalities, except in these cases the market for cleaning up air or building sidewalks doesn’t exist at all. No suppliers enter the market because they cannot get demanders to pay them for something they cannot be excluded from for free.

Differences Between Public and Private Sectors

Differences between the public and private sectors are fundamental and arise from the distinct purposes, organizational structures, and operational principles of these two domains. In the public sector, the primary objective is to serve the public interest and provide essential services, often funded by taxpayers’ money. Public sector organizations are subject to extensive regulations and scrutiny, emphasizing transparency and accountability. In contrast, the private sector is profit-driven, focused on generating revenue and maximizing shareholder value. Private organizations have greater flexibility in decision-making, adaptability to market dynamics, and competitive pressures. These differences manifest in areas such as organizational culture, management practices, resource allocation, and the degree of risk-taking. Understanding these distinctions is essential for effective governance, policymaking, and career choices within these sectors.

Scale

The scale of operations in the public and private sectors is markedly different due to the diverse nature of their goals and responsibilities. The public sector, comprising governmental agencies and institutions, operates on a larger scale both in terms of scope and societal impact. It is responsible for providing essential services to the entire population (or large swaths thereof), such as education, healthcare, public safety, and infrastructure. The scale of the public sector’s activities is driven by its commitment to serving the public interest, ensuring social welfare, and addressing the needs of diverse communities.

Conversely, the private sector operates with a narrower focus, often centered around specific industries or markets. While certain private sector enterprises may achieve significant size, their activities are almost always geared towards profit generation within their chosen sectors. The private sector’s scale of operations is shaped by market demand, consumer preferences, and competitive forces. Private sector organizations generally aim to optimize their operations to achieve financial success and market their products and services within their designated niches.

The sheer magnitude of resources at the disposal of the public sector often eclipses that of individual private sector entities. Government agencies wield substantial budgets and have access to extensive public funds for fulfilling their comprehensive mandates. This allows the public sector to tackle complex challenges on a broad scale, such as managing large-scale public infrastructure projects or delivering nationwide social welfare programs.

In contrast, private sector entities operate with resources that are tied to their specific industries or market reach. While some large corporations have considerable resources, their operations are typically limited to their core business activities. They focus on achieving efficiency and profitability within their defined scope, rather than taking on the comprehensive responsibilities of public sector agencies.

Goals and objectives

The distinction between the public and private sectors is underscored by their divergent goals and objectives. These fundamental differences stem from the distinct roles and responsibilities these sectors undertake within society. The public sector, primarily comprised of government entities and institutions, is oriented towards the collective welfare and public interest. Its overarching goal is to ensure the provision of essential public services, uphold social equity, and promote the well-being of citizens (life, liberty and property).

On the other hand, the private sector, composed of profit-driven enterprises and businesses, operates within a distinctly market-oriented context. Its principal objective is to generate profits and maximize shareholder value. The private sector’s primary goal revolves around economic success, innovation, and competition. Unlike the public sector, which is primarily driven by social welfare considerations, the private sector seeks to satisfy consumer demands, create market differentiation, and achieve financial growth. This often translates into strategies focused on efficient resource allocation, product development, and market expansion, all of which are aimed at achieving a competitive edge and financial prosperity.

While some companies in the public sector emphasize the public good through things like the equitable distribution of resources and societal well-being, these are second to capital accumulation and economic advancement. A company like Tom’s may send a pair of shoes to Africa for each pair that is sold, however their primary objective is to make a profit selling shoes. The private sector’s objectives are intrinsically linked to market dynamics and shareholder interests, driving decisions that are financially motivated and targeted at achieving competitive advantage.

In essence, the dichotomy between the public and private sectors’ goals and objectives showcases the divergent priorities each sector upholds. The public sector’s focus on societal welfare and equity contrasts with the private sector’s profit-oriented pursuits.

Recognizing these distinctions is crucial in understanding how these sectors contribute to the broader societal landscape and how their actions shape economic and social outcomes.

Governance

Governance structures in the public and private sectors reflect the contrasting nature of their operations and objectives. The public sector, made of governmental bodies and agencies, adheres to a system of democratic governance. It operates under the framework of public accountability, with decisions made in the interest of the citizens and the overall welfare of the society. Public sector governance is characterized by transparency, responsiveness to public needs, and adherence to complex systems of laws and regulations. Elected officials and appointed administrators are responsible for overseeing the delivery of public services and ensuring that decisions are made with the broader public interest in mind.

Conversely, the private sector’s governance is primarily driven by market dynamics and ownership structures. Corporate governance within the private sector is centered around the interests of shareholders, who invest capital in the organization with the expectation of financial returns. Private sector entities are guided by the pursuit of profit and value creation for shareholders. Corporate boards of directors and executive management are accountable to shareholders and aim to make decisions that enhance the company’s financial performance, market position, and long-term sustainability. While regulatory requirements may exist, the private sector has greater leeway in determining its strategic direction and operational practices compared to the public sector.

Another crucial distinction lies in the mechanisms of accountability. In the public sector, accountability is rooted in democratic principles and is owed to the citizens. Government agencies are subject to public scrutiny, transparency, and oversight through mechanisms such as legislative control, audits, and citizen engagement. Decisions made by public officials are expected to align with the public interest and are open to review and debate.

In contrast, private sector governance is primarily driven by financial performance and shareholder interests. Accountability in the private sector is often enforced through market mechanisms, where investors reward or penalize companies based on their financial results and strategic choices. Corporate governance practices may include board oversight, financial reporting, and adherence to industry standards. While both sectors have governance systems in place, the public sector’s focus on democratic representation and the public good stands in contrast to the private sector’s emphasis on market dynamics and shareholder value.

The distinction between the public and private sectors becomes apparent when examining their funding mechanisms. The public sector primarily relies on public funds, which are collected through taxation and government revenues. These funds are allocated to provide essential services and support public infrastructure that benefits society as a whole. Public sector funding is directed towards areas such as education, healthcare, transportation, and social welfare, with the goal of ensuring equal access and addressing societal needs. The transparent nature of public funding requires accountability to taxpayers and emphasizes responsible management of public resources.

In contrast, the private sector is predominantly funded by private capital, which includes investments from individuals, shareholders, and financial institutions. Private sector entities seek to generate profits and create value for investors by offering goods and services in the market. Funding in the private sector often involves securing loans, issuing stocks, or attracting venture capital to finance business operations, research, development, and expansion. The primary objective of private sector funding is to drive financial returns and maximize shareholder value.

The sources of funding also influence decision-making and priorities. In the public sector, funding allocation is subject to democratic processes and public input. Budget decisions are often debated and determined by elected officials, who must consider the diverse needs of the population. Transparency and accountability are crucial in the public sector to ensure that tax revenues are utilized efficiently and equitably.

On the other hand, the private sector’s funding sources are connected to market performance and investor expectations. Decisions in the private sector are often driven by the goal of achieving profitability and growth. Businesses must respond to consumer demand, market competition, and economic trends to attract investment and maintain financial stability. Private sector entities have the flexibility to adjust their strategies based on market conditions, making funding and financial decisions crucial to their success.

The management structures of public and private sector organizations also differ. Public sector organizations are typically hierarchical, with a clear chain of command and strict rules and procedures. Public sector managers are responsible for ensuring that public resources are used effectively and efficiently to deliver public goods and services. In contrast, private sector organizations are often flatter and more flexible, with a focus on innovation and efficiency to generate profits.

Management practices in the public and private sectors exhibit distinct characteristics shaped by their respective missions and operational dynamics. The public sector’s management approach is grounded in public service and accountability. Public sector managers are responsible for efficiently delivering essential services to the community, upholding social equity, and managing resources for the collective welfare.

Management decisions in the public sector are influenced by democratic processes, transparency, and the obligation to meet the diverse needs of citizens.

Public sector management prioritizes long-term societal benefits over short-term financial gains. In contrast, the private sector’s management focus is directed towards maximizing profits and shareholder value. Private sector managers are driven by market competition, consumer demand, and financial performance. They work to optimize operational efficiency, product quality, and customer satisfaction to enhance revenue generation. Decisions in the private sector are often geared towards achieving competitive advantages, market share, and profitability, with the aim of sustaining business growth and satisfying investor expectations.

Management accountability differs significantly between the two sectors. In the public sector, managers are accountable to elected officials, regulatory bodies, and the public they serve. Transparency and openness are essential to maintain the trust of citizens and ensure the proper utilization of public resources. The performance of public sector managers is evaluated based on their ability to deliver public services effectively and equitably, often under the scrutiny of public oversight.

In the private sector, management accountability is primarily tied to shareholder interests. Private sector managers are answerable to boards of directors and shareholders, whose main concern is the company’s financial success. Profitability and return on investment are the key metrics used to evaluate the effectiveness of private sector management. Private sector managers often have more autonomy in decision-making, as they are guided by market trends and the goal of generating financial returns.

Human resources practices in the public and private sectors exhibit notable distinctions due to their distinct organizational objectives and operating environments. In the public sector, human resources management centers on serving the public interest and delivering essential services to the community. Public sector employees are often driven by a sense of civic duty, working to address societal needs and promote the welfare of citizens. Human resources policies emphasize fairness, transparency, and equal opportunity, aiming to provide a diverse and inclusive workforce that reflects the community it serves.

Conversely, in the private sector, human resources management is driven by the pursuit of organizational profitability and competitiveness. Private sector employees are typically motivated by individual career growth and financial incentives, as their roles contribute to the company’s financial success. Human resources policies in the private sector focus on talent acquisition, performance-based rewards, and workforce optimization to enhance productivity and market competitiveness.

The nature of compensation also differs between the sectors. In the public sector, compensation structures often prioritize job stability and benefits, aligning with the public service ethos. Wages are typically structured to be competitive with comparable public sector roles and are influenced by budgetary considerations and political factors. In contrast, the private sector’s compensation model tends to be performance-driven, with variable pay, bonuses, and stock options designed to incentivize employee contributions that directly impact the organization’s financial performance.

Human resources decision-making also contrasts between the sectors. In the public sector, decisions are influenced by bureaucratic procedures, civil service regulations, and government policies. Recruitment and promotions are often subject to standardized procedures that prioritize equal treatment and non-discrimination. In the private sector, decisions are guided by market demands, individual performance evaluations, and the need to remain agile in response to industry shifts. As a result, human resources practices in the private sector may entail more flexibility and adaptability.

Summary

The public sector in the United States is a vital component of governance, encompassing all government entities at the federal, state, and local levels. It plays a multifaceted role in shaping and serving the nation, with a particular focus on providing essential services, maintaining law and order, regulating the economy, protecting national security, and ensuring democratic governance. Within the public sector, public employees are central to the execution of these functions.

One of the foremost functions of the public sector is the provision of essential services to the American populace. These services encompass education, healthcare, public safety, transportation, and social welfare. Public employees, such as teachers, healthcare professionals, law enforcement officers, and social workers, are at the forefront of delivering these services. They work within government agencies and departments to design and implement policies and programs aimed at ensuring access, affordability, and quality in these critical areas.

Economic Regulation: Regulatory agencies and public employees within them are responsible for regulating the national economy. Government bodies set economic policies and regulations to promote growth, stability, and sustainability. Public employees in agencies such as the Securities and Exchange Commission (SEC) and the Environmental Protection Agency (EPA) oversee industries to ensure fair competition, protect consumers, and address issues like financial fraud and environmental conservation.

National Security: Safeguarding national security is a paramount duty of the public sector, and it relies on the dedication of public employees. These individuals, often serving in the military or intelligence agencies, work diligently to protect the country from threats both domestically and abroad. They contribute to maintaining a strong defense, engaging in international diplomacy, and securing critical infrastructure.

Democratic Governance: Public employees within government agencies are crucial for ensuring democratic governance. They promote civic engagement, protect voting rights, and ensure elected officials remain accountable to the people. Public sector employees, including those overseeing elections and government transparency, play a pivotal role in upholding the democratic principles on which the nation was founded.

Understanding the public sector’s diverse roles, coupled with the pivotal contributions of public employees, is vital for citizens, policymakers, and stakeholders. Together, they collaborate to formulate policies and programs that meet the needs of the population and advance the common good, all while upholding the principles of democracy and public service.

Bibliography

29 funniest tax season memes ever. (2021). https://worldwideinterweb.com/tax-return-memes/

Congressional Budget Office 2022 cost estimate. (n.d.). https://www.cbo.gov/system/files/2022- 08/hr5376_IR_Act_8-3-22.pdf

Cornwell, S. (2016). Conservatives in Congress urge shutdown of IRS. Reuters. https://www.reuters.com/article/us-usa-taxes-congress/conservatives-in-congress-urge- shutdown-of-irs-idUSKCN0XT0TF

Does the GOP really want to abolish the IRS?: The takeaway. (2015). WNYC Studios. https://www.wnycstudios.org/podcasts/takeaway/segments/abolish-irs-campaign-online-silence- among-gop-ranks

Federal tax research guide: CCH federal tax reporter. (n.d.). CCH Federal Tax Reporter https://law.indiana.libguides.com/c.php?g=17207&p=95936#s-lg-box-2834890

Fuller Beng, R., Landringan, P., Balakrishnan, K., Bathan, G., Bose-O’Reilly, S., Brauer, M., Caravanos, J., Chiles, T., Cohen, A., Corra, L., Cropper, M., Ferraro, G., Hanna, J., Hanarahan, D., Hu, H., Hunter, D., Janata, G., Kupka, R., & Lanphear, B. (2022, May 18). Pollution and health: A progress update. The Lancet Planetary Health. https://www.sciencedirect.com/science/article/pii/S2542519622000900?via%3Dihub

Hodge, S. (2023). IRS is raising more with less, but new funding misses the mark. Tax Foundation. https://taxfoundation.org/irs-budget-increase-technology/

IRS budget and Workforce | Internal Revenue Service. (n.d.). https://www.irs.gov/statistics/irs- budget-and-workforce

Kettl, D. F. (2016). Escaping Jurassic government: How to recover America’s lost commitment to competence. Brookings Institution Press.

Kiel, P., & Eisinger, J. (2018). How the IRS was gutted. ProPublica. https://www.propublica.org/article/how-the-irs-was-gutted

Levy, P. (2016). What did Congress sneak into the last-minute spending deal? Newsweek. https://www.newsweek.com/what-did-congress-sneak-last-minute-spending-deal-291090

Light, P. C. (2018). The true size of government. OUP Academic. https://academic.oup.com/book/12459/chapter/162088112

Population United States 2022. (2023). Statista. https://www.statista.com/statistics/183457/united-states-resident-population/

Rappeport, A. (2021). For Republicans, deep wounds fuel resistance to bolstering the I.R.S. The New York Times. https://www.nytimes.com/2021/07/23/us/politics/republicans-infrastructure-irs- tax-gap.html?login=email&auth=login-email

Share of people employed in government by country 2019. (2022). Statista. https://www.statista.com/statistics/1235570/share-of-people-employed-in-government/

Swagel, P. (2021). The effects of increased funding for the IRS. Congressional Budget Office. https://www.cbo.gov/publication/57444

U.S. Bureau of Labor Statistics. (n.d.). All Employees, Federal [CES9091000001], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CES9091000001

U.S. G.A. Office. (n.d.). Tax compliance: Trends of IRS audit rates and results for individual taxpayers by income. U.S. GAO. https://www.gao.gov/products/gao-22-104960

World Bank. (n.d.). The global health cost of PM2.5 air pollution: A case for action beyond 2021. Open Knowledge Repository. https://openknowledge.worldbank.org/handle/10986/36501

Media Attributions

- IRS Data Books, Tables 31 and 32 data in the public domain. is licensed under a Public Domain license

- Tweet

- National Accounts at a Glance. General government spending. © OECD is licensed under a All Rights Reserved license

- Density map of special district governments in the United States. Nebraska Library Commission.

- Air pollution © Roentahlenberg. is licensed under a CC BY (Attribution) license

- Military jet © Greg L. Davis, U.S. Air Force. is licensed under a Public Domain license

- Pizza for dinner. © Jon Sullivan is licensed under a CC0 (Creative Commons Zero) license

- Old car © Inmemo. is licensed under a CC BY (Attribution) license

- Laptop is licensed under a CC BY (Attribution) license